Tokens Stream

News from the world of cryptocurrencies. Stay up to date with the latest news

Admin: @iqcash_admin Связанные каналы

169 084

obunachilar

Kanalda mashhur

🚀 Bitcoin Bulls Unite: Arthur Hayes Sees $1 Million Price Tag as Weak Yen Sparks a Crypto Surge ...

🏆 Blackrock's IBIT Nears Grayscale's GBTC in Bitcoin Reserves 💰 Inflows Galore: Spot bitcoin ETF...

🤑Sirwin Crypto Casino🤑 💰Win Win SirWin Join Us Big Win! Jackpot is await for you!💰 🎁Welcome off...

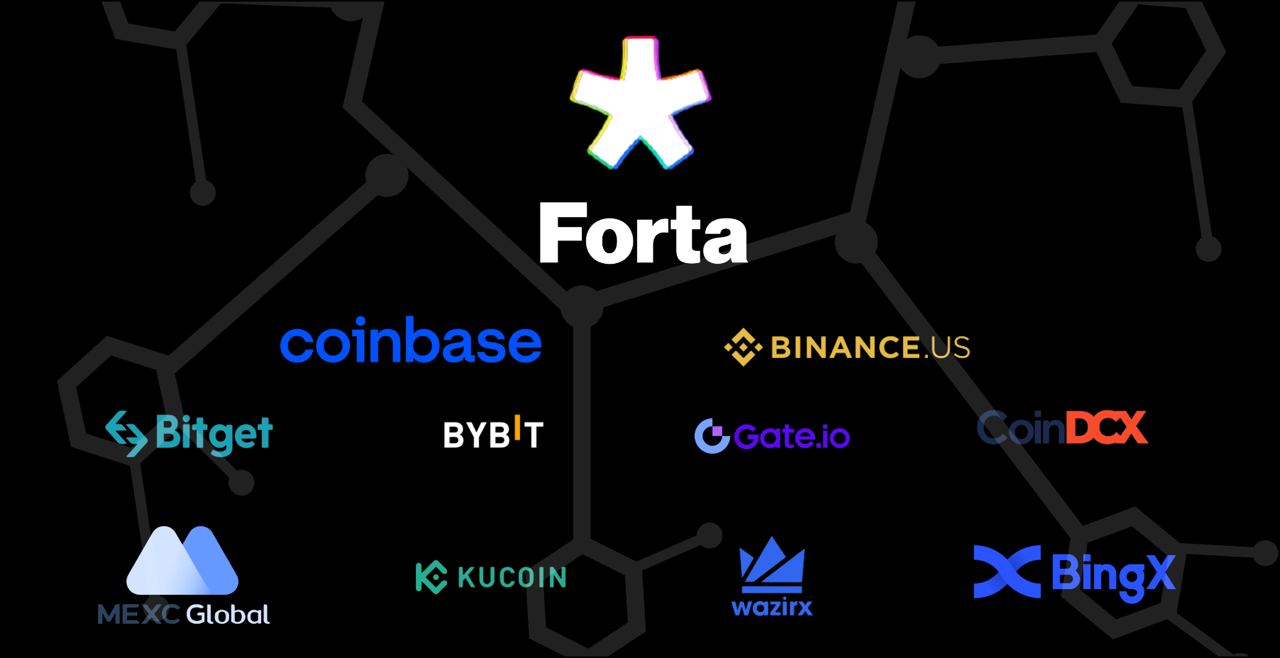

💼 Backed by Coinbase Ventures, a16z, Blockchain Capital, OpenZeppelin, and many others. 🔐Trusted...

📈 Trump's Triumph: Polymarket Bets Soar to $155.78M, Favoring 56% Chance of Re-Election 🤔 The Tr...